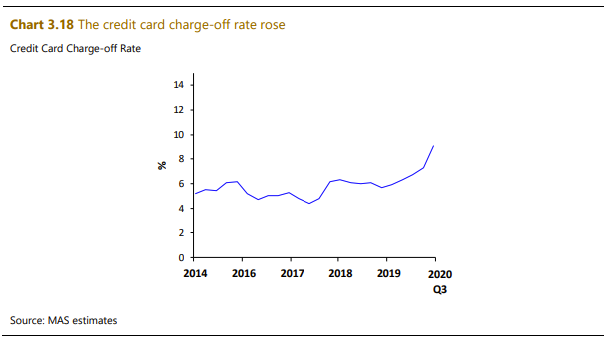

On 1 December, the Monetary Authority of Singapore (MAS) noted in its annual financial stability review that, as a result of an gradual uptrend in unsecured credit charge-off rate in Q3 2019, more households could “face difficulties in their housing payments” in the coming months.

Examples of unsecured credit are credit cards and personal lines of credit. The unsecured credit charge-off rate, which measures bad debt written off during the year against the average rollover balance, increased from 5.9% to 9.1% between the third quarter of last year and the same period this year.

According to MAS, the unsecured credit charge-off rate is a leading indicator for the credit quality of housing loans. This is because, in an initial period of financial distress, a borrower is likely to first miss payments for their unsecured credit bills. This may lead to defaults on monthly home loan repayments in the near future.

MAS also noted in its report a silver lining, property asset values have remained robust in 2020, which is helping sustain asset values and household net wealth.

Advertisement

Households more financially vulnerable than last year

As Covid-19 led to a shape fall in employment and wage incomes of Singaporeans in the first-half of this year, the overall Household Sector Financial Vulnerability Index, or FVI, increased in Q3 2020, MAS reported.

Since the circuit breaker in Q2 2020, household debt-to-GDP, which had been declining pre-Covid, increased 1.9 percentage points from 63.1% in Q1 2020 to 65.0% in Q2 2020, and a further 2.1 percentage points to 67.1% in Q3 2020.

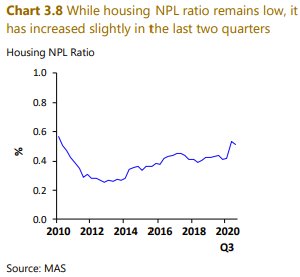

The housing Non Performing Loans (NPL) ratio also “increased slightly in the last two quarters” by about 0.1%, although the ratio remains well below 1% at about 0.5% currently (which means one out of about 200 borrowers have issues with on-time housing loan repayment). Housing loans account for about three-quarters of total household debt, and are a key determinant of overall household financial vulnerability, according to MAS.

At the same time, household debt as a percentage of income, which has remained stable since 2015, is expected to “increase slightly in the near term as accumulated labour market slack weighs on wages,” MAS said.

Despite reduced income and GDP, simulations by MAS suggest that Singapore households’ debt servicing burden “remains manageable” under the stress of both current and potentially extended Covid-19 economic impacts. Assuming further income shocks of up to 25%, median household mortgage servicing ratios (MSR) will still remain lower than 60%.

Advertisement

According to the report, property cooling measures in preceding years, such as the tightening of the loan-to-value (LTV) ratio, were helpful in improving households’ balance sheets. Household liquid assets, such as cash and deposits, continued to exceed total liabilities in Q3 2020, providing households a financial buffer against income shocks.

Furthermore, relief measures have also been instrumental in helping households with cashflow concerns. About 36,000 applications to defer property loan repayments have been made as of August this year.

[Recommended article: Here’s all the things property buyers/owners can defer paying until 2021]

Property market buoyant, sustaining asset values and households’ net wealth

According to the MAS report, household net wealth (defined as household assets less household debt) increased from 3.8 to 4.4 times of GDP from Q3 2019 to Q3 2020.

MAS noted that while the increase is partly due to the fall in GDP caused by Covid-19, the increase in household net wealth is also a result of asset values (such as equity and property prices) remaining robust despite the economic slowdown.

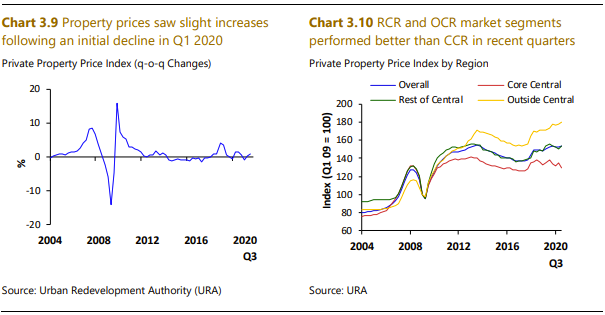

The private residential market has remained resilient in 2020, MAS said. Prices returned to pre-Covid-19 levels in Q3 2020 following an initial decline in Q1 2020. The recovery of transaction activity in Q3 2020 is also supported by an “accomodative interest-rate environment“.

Compared to the Global Financial Crisis in 2008 and 2009, MAS noted that prices of private homes had “less pronounced volatility” that “points to some degree of underlying support and resilience in the market.

Advertisement

Unlike in the previous periods where price trends across different regions were aligned, the the Rest of Central Region (RCR) and Outside of Central Region (OCR) saw price gains of 0.3% and 1.4% in 2020 to date respectively, compared to price declines of 3.4% in the Core Central Region (CCR).

Transaction activity for private homes was driven by resident purchases, with foreign demand remaining low because of continuing travel restrictions, MAS noted. As of Q3 2020, residents (citizens and permanent residents) accounted for around 95% of all transactions, and Singapore citizens’ share of transactions inched up to a “historic high” of 81.9%, according to MAS.

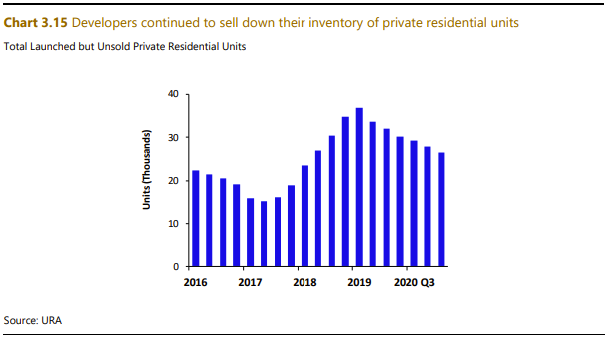

As a result of a buoyant property market, the number of unsold units in the supply pipeline declined for the sixth consecutive quarter as the recovery in developers’ sales outpaced additions to unsold supply inventory, MAS noted. The supply of unsold units are now down to Q2 2018 levels.

MAS also noted improving developer sentiment. “Given the progressive decline in unsold inventory, some developers have been keen to replenish their landbank as reflected by the healthy participation for the Government Land Sales (GLS) tenders which closed in October 2020,” it said.

Sentiment among developers was also helped by the government’s temporary relief measures that extended their deadlines for Additional Buyer’s Stamp Duty (ABSD) remission and Project Completion Period. These measures provided developers some flexibility to manage their sales timelines.

“Developers are under less immediate pressure to move units to meet ABSD remission deadlines,” said MAS.

Rental vacancies fall, CCR worst hit

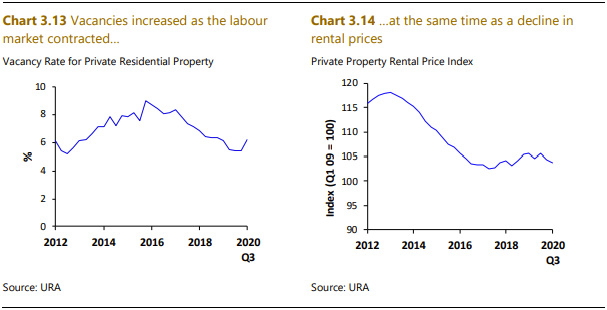

Hiring slowdowns and departure of expatriates due to Covid-19 have caused vacancy rates of private residential properties to increase from 5.4% and 6.2% between Q2 and Q3 2020, reversing a downtrend since 2016.

Rentals declined for a second successive quarter by 0.5% in Q3 2020 but, similar to price trends, it was only the CCR that took the hit. Amongst non-landed properties, CCR rentals fell by 2.1% but RCR and OCR rentals increased by 0.3% and 1.0% respectively.

Advertisement

For landlords affected by the fall in rental demand, MAS warns that “borrowers relying on rental income to meet their mortgage instalments on investment properties could face difficulties in repayment.”

“Prospective buyers should accordingly factor in the possiblity of further weakness in rental income when committing to purchases of investment properties,” it added.

Exercise prudence when buying property, MAS advises

“Close monitoring of housing loans from more vulnerable households is necessary in the upcoming months given that the labour market recovery will be protracted,” the MAS said.

Aware that some households that currently have a strong cash and liqudity balance and may be considering upgrading or making new property purchases, MAS urged them to be cautious, and to consider refinancing existing loans.

“Households should be prudent in taking up new debt and in committing to property purchases as the labour market recovery is expected to be protracted. Whenever possible, they should continue servicing or consolidating their existing obligations to enhance resilience against unexpected shocks.”

2 days ago · 6 min read ·

Source: 99.co

Advertisement